Shipments from non-EU countries

Should your product be shipped from a country outside the EU, it must be placed under the customs procedure „release for free circulation” and delivered according to Incoterm® DDP (Delivered Duty Paid).

In accordance with the Incoterm® DDP (Delivered Duty Paid) the sender is responsible for all charges relating to shipment, including any customs duties, fees and taxes.

Please ensure that you have a personal account with a reputable parcel service provider for the shipment of your parcel. This will assist in addressing any potential customs clearance inquiries.

Helpful customs advices

Please declare your shipment at customs by stating detailed information about the content and value of your shipment by using a proforma invoice.

- Common description of the content

- Detailed description of the content

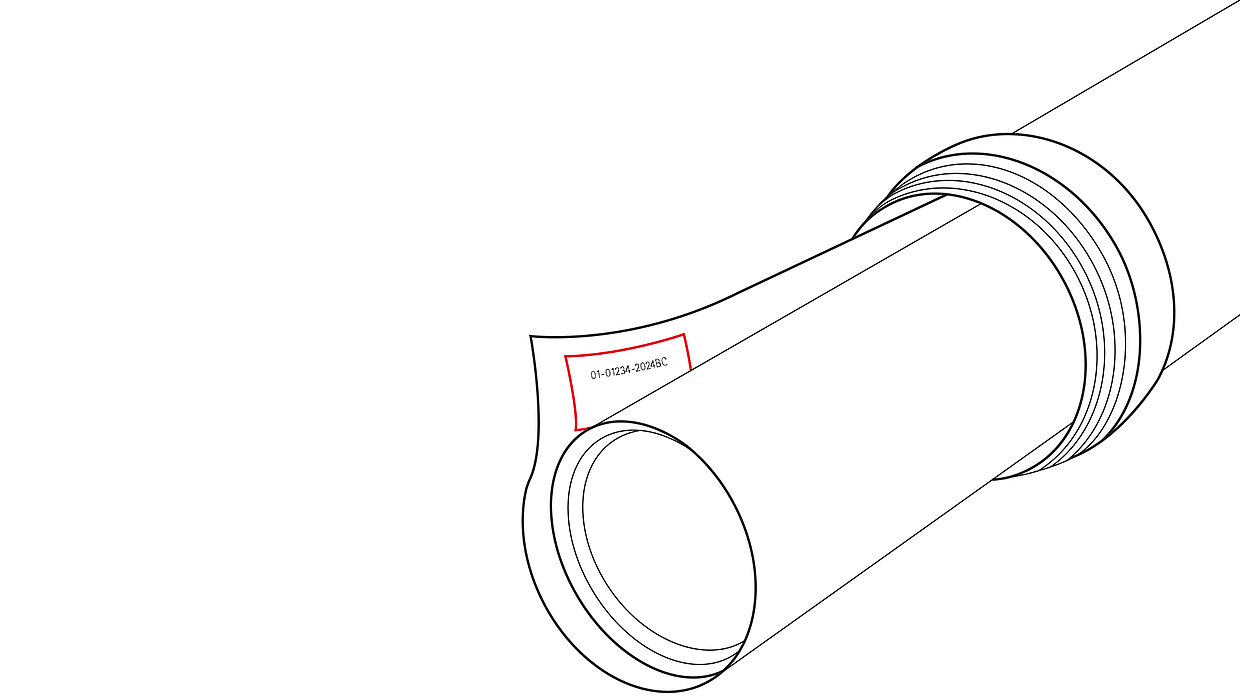

- Product name, trade name, model number

- Customs tariff code / HS code

- Material, color

- Quantity

- Country of origin

- Realistic value of the content

- Address and contact information of the sender and receiver

For the proforma invoice, you can use this template to prepare your proforma invoice. Some couriers provide their own shipping documents. Please check beforehand if they will provide the documents or if you need to prepare them yourself.